What is ACCA Skill Level? Subjects, Tips for 2025

What is ACCA Skill Level? Subjects, Tips for 2025

Blog Article

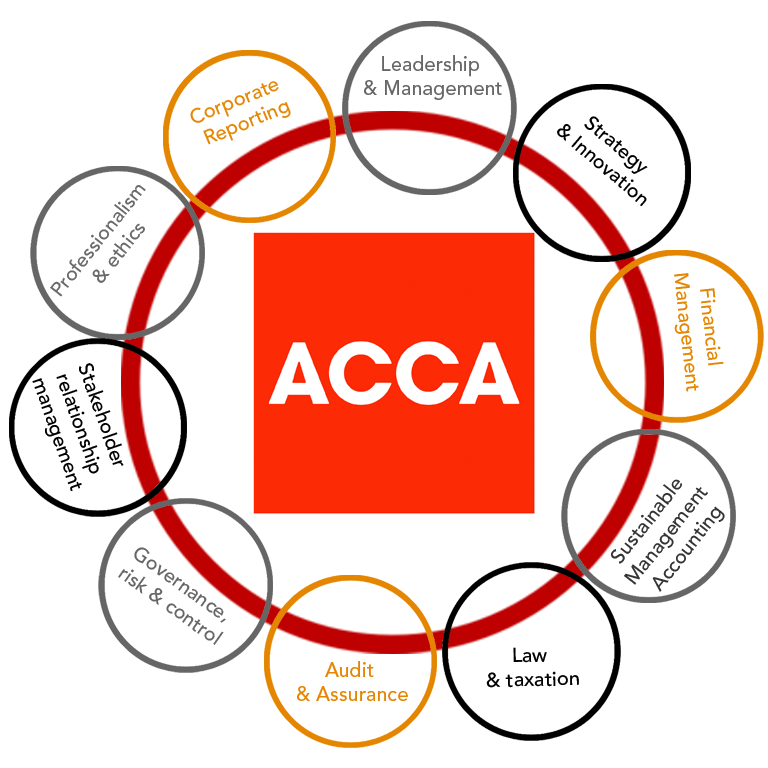

Overview of ACCA Skill Level

ACCA Classes

ACCA Classes In Pune

ACCA skill level: the second ACCA qualification level that develops the candidate’s technical knowledge, problem-solving ability, and analytical skills in key areas related to finance, taxation, and corporate governance.

This level has six compulsory exams that cover a wide variety of accounting and financial concepts. This helps professionals in meeting the competency requirements for ACCA Strategic Professional Level or to help them take up senior roles in the organization.

The importance of the ACCA Skill Level

- Closes the gap between theory and practice

- Helps candidates meet real-world business challenges

- These are essential technical skills for financial professionals

- Derive strong analytical as well as decision-making skills bestows employability

Exams in ACCA Skill Level

The ACCA Skill Level consists of six exams which aim to test the candidates on all aspects of financial and business management. Let’s follow through them to understand each better:

1. Business Law (LW)

This is a subject that deals with the laws that apply to businesses and corporations. The syllabus includes:

- Basic principles of contract law

- Principles of corporate governance

- Employment law

- Business telephone services and some legal implications

- Building and Charting the Companies

How is this relevant to the topic at hand?

In the world of finance and accounting, understanding business law is crucial since accountants must ensure that their clients comply with corporate or business laws to avoid any possible legal disputes so that they can advise them accurately about any legal matters.

2. Performance Management (PM)

What is Performance Management? Performance Management streamlines accounting techniques to enable business decisions. The syllabus includes:

- Methods of costing and methods of pricing

- Budgeting and forecasting

- Variance analysis

- Metrics and measurement techniques

- Risk management

This topic is a significant relevant topic because,

They use their knowledge of performance management to help the companies increase efficiency, reduce costs, and drive performance through financial planning.

Get More Details Face to Face ACCA Classes in Pune & ACCA Online Classes

3. Taxation (TX)

So, this paper is basically all about taxation systems and all their applications in different scenarios. The syllabus includes:

- Principles of taxation

- Computation of Income tax for individuals & business

- Corporate tax, VAT and capital gains tax

- Tax planning strategies